After months of speculations, last week, Facebook announced that the social media giant would lift the curtains on “Libra,” a brand-new cryptocurrency, sometime in 2020. Facebook announced that Calibra is a newly formed subsidiary to the parent company and aims to provide seamless and secure financial services by using the Libra network.

Calibra and Libra: A Quick Explanation

While Libra is a digital currency, it doesn’t have much in common with Bitcoin, the original cryptocurrency. The value of Bitcoin is basically because of its scarcity, and though it has been around for nearly a decade, it’s still considered a niche currency, not used for daily, everyday payments.

Libra, is like Bitcoin, in that it will be tied into a blockchain (this blockchain is currently under development by Facebook). The similarities end there. Unlike Bitcoin, you cannot mine Libra. Instead, you must pay for it and purchase it.

Facebook believes that Libra will become the global currency standard, like the popular currencies USD, GBP, and EUR.

Coming to the all-important question: how will the value of Libra be determined, since it doesn’t have real-world assets like a country backing it?

This is where things turn interesting. The value of Libra will be guaranteed by real assets provided by the partners that buy into Facebook-cofounded Libra association. Facebook has managed to rope in industry biggies, including venture capitalists, tech companies, and non-profit associations.

eBay, Lyft, Spotify, Uber, Union Square Ventures, PayPal, Visa, and Mastercard are some of the top names in the association. You can find more about the founding members of the Libra Association in the whitepaper published by Libra. The company will have its headquarters in Geneva, Switzerland.

What does this mean for Regular Users?

Will it bite the dust like that time when Facebook was trying developing nations to use its platform for all their internet access by offering them free internet? Or will Libra become the first-ever digital currency to go mainstream?

While that needs to be seen, Facebook’s goal here is to make Libra the go-to currency for transferring funds to friends and family in other countries and to make it the number one payment option for both online and offline purchases.

Initially, Facebook will offer Libra as part of WhatsApp and Facebook Messenger, with plans to move it into a stand-alone app, later.

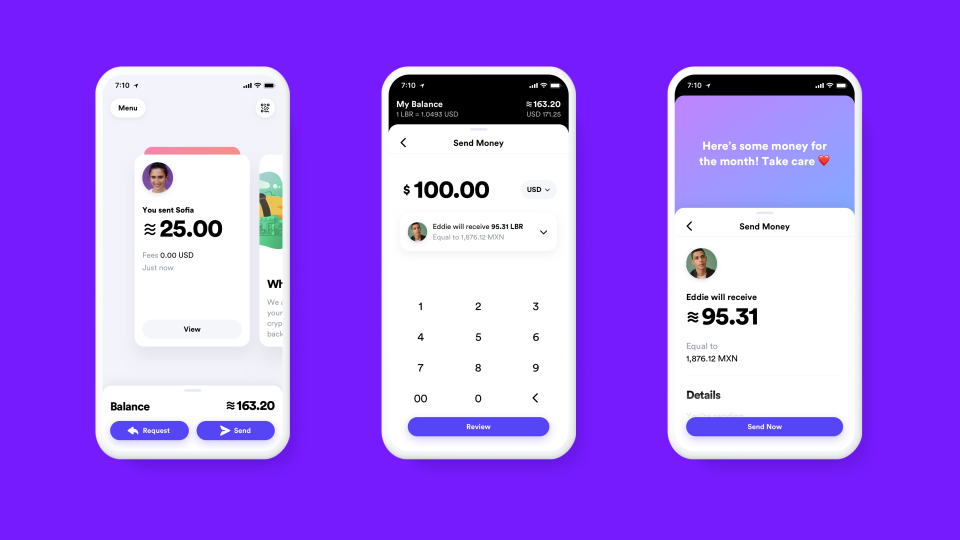

This is where Calibra comes into the picture. Calibra is a digital wallet that will help users to save, spend, and send Libra. Initially, you can use the Calibra wallet to send and receive money instantly to anyone with a smartphone. Later Facebook plans to extend the functionality of Calibra to provide financial services for small businesses like paying bills, etc.

sneak peek into Calibra’s interface, courtesy of Facebook.

sneak peek into Calibra’s interface, courtesy of Facebook.

Calibra will use anti-fraud, and verification processes used by all leading credit cards, and provide live support to people who misplace their smartphone. Calibra even promises refunds if you lose your Libra because of fraudulent activities. Calibra will also value user privacy and will not share financial data with Facebook or other third-parties.

Facebook claims that they are still a long way from launching Calibra. Interested users can sign up here to join the newsletter to be the first to receive information about the progress of Calibra and Libra.

How will Libra and Calibra impact Businesses that sell via/on Facebook?

Industry experts believe that entrepreneurs using Facebook pages for information about their products will not be impacted much. However, if you sell goods via Facebook, then you would have to make changes to include Libra as one of the payment currencies.

However, since Facebook has an enormous reach, at least a few of your customers will be using the new crypto coin. Hence, it makes sense to include it in your payments page.

When should you start making changes to include Libra?

No hurries. Facebook is still in the process of development, and nothing has been confirmed yet. So, businesses need not panic and spend the interim time reading up on the merits and drawbacks of this brand-new venture from Facebook.